Making Tax Digital for B&B Owners in the UK (2026 Guide)

Jan 05, 2026Updated for January 2026: This post was originally published in March 2025 and has been updated to reflect the latest Making Tax Digital guidance, thresholds and start dates.

At the beginning of last year I wrote a blog post explaining the basics of Making Tax Digital for UK B&B owners and who it applied to.

At the time, HMRC were still working through the finer details, and a lot of the guidance was either missing or subject to change. Since then, more detailed information has been published, and the timelines are now much clearer.

So I’ve updated this post to reflect the current guidance and what we now know about Making Tax Digital and how it affects small bed and breakfasts in the UK.

As always, this comes with the proviso that I’m not a financial expert (at all), just a small business owner working through what this actually means in practice.

Please note: This blog is specifically for UK-based B&B owners. If you’re running a bed and breakfast in another country, the tax rules where you are may be completely different, so it’s best to check with your own local tax authority.

Disclaimer: This blog is for general information only and should not be taken as tax or financial advice. I’m not an accountant or tax adviser, and while I’ve done my best to make sure everything is correct at the time of writing, I can’t guarantee the accuracy.

You should always do your own research or speak to your accountant or bookkeeper. This post was created with the help of AI (ChatGPT) and based on information from official UK government sources.

For the most up-to-date guidance, visit: Making Tax Digital – GOV.UK

A note about advice you find online (including AI tools)

You’ll see plenty of advice online about tax, regulations, and even how to set up and run a B&B — including suggestions to “just ask ChatGPT”. Tools like this can be useful for getting an overview or helping you understand unfamiliar terms, but they’re not a substitute for proper advice.

While updating this post I double-checked everything against HMRC’s own guidance, because even well-meaning AI tools and online articles can get details wrong or miss important nuances. In fact, ChatGPT gave me the wrong information several times while writing this post.

If something matters financially or legally, it’s always worth checking official guidance or speaking to an accountant, your local authority, or another appropriate professional rather than relying on online advice alone.

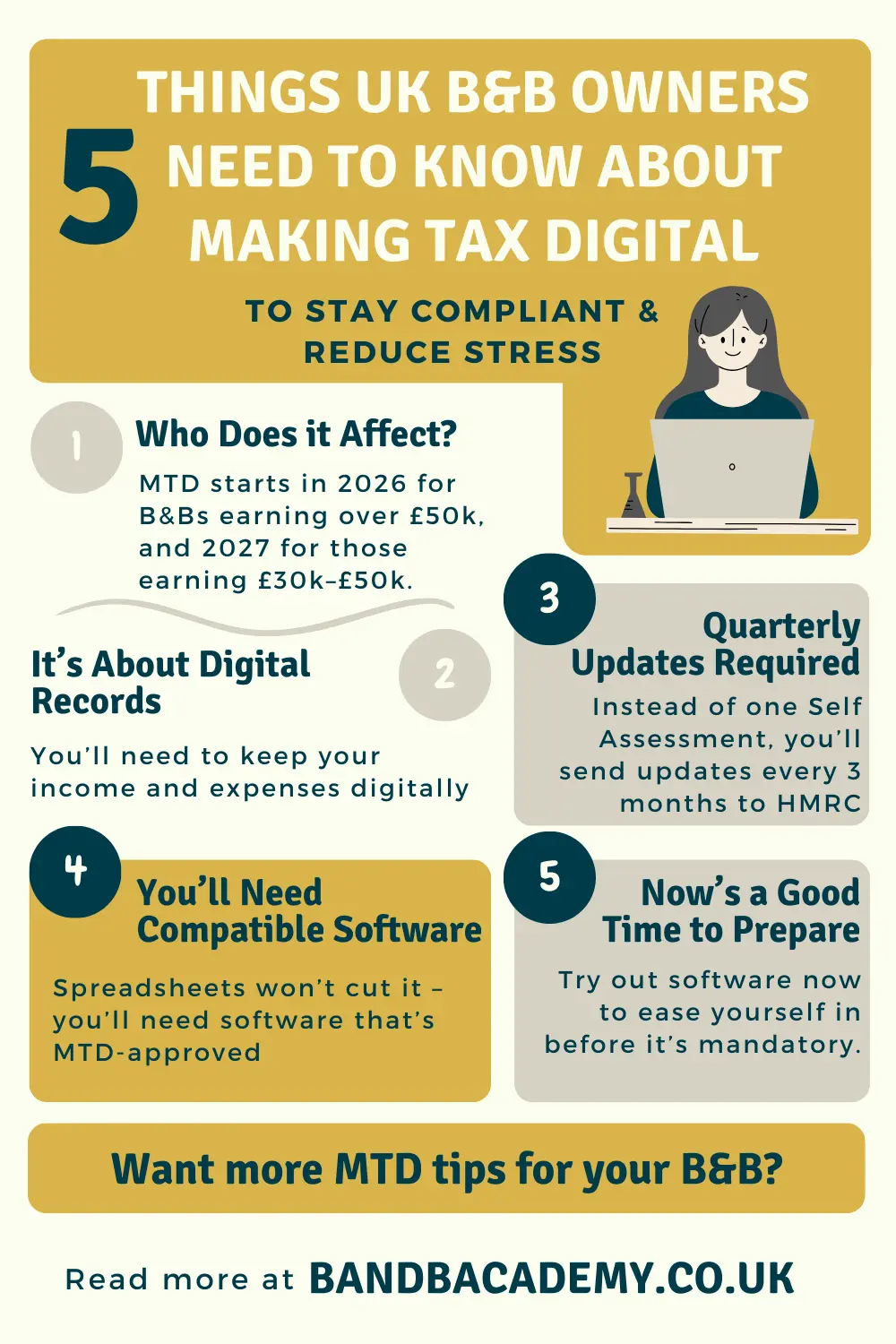

Does Making Tax Digital apply to B&B owners?

For most UK B&B owners, the answer is yes, because you’re usually classed as a sole trader.

For sole traders, Making Tax Digital is based on total income before expenses, not profit. When HMRC talk about income, they mean:

- Your B&B takings

- Any other self-employment income

- Any rental or property income

All of that is added together.

PAYE income and pension income aren’t included when working out whether Making Tax Digital applies, even if that income is declared on a tax return and taxed via Self Assessment.

If your B&B is run as a partnership, the position is different. Making Tax Digital for Income Tax has been delayed for partnerships, and there is currently no confirmed start date.

If your B&B is run as a limited company, in July 2025 HMRC confirmed that they do not intend to introduce Making Tax Digital for Corporation Tax.

There’s more guidance here → Find out if and when you need to use Making Tax Digital for Income Tax

If you’re unsure, get advice

If any of this feels unclear, or your situation isn’t straightforward, you should speak to your accountant or bookkeeper, or check directly with HMRC.

Making Tax Digital is based on specific definitions and thresholds, and a quick conversation can save a lot of second-guessing. It’s far better to ask early than to assume it doesn’t apply and find out later that it does.

When you need to start using Making Tax Digital

When you need to start using Making Tax Digital for Income Tax depends on your qualifying income in a specific tax year.

- If your qualifying income is over £50,000 in the 2024–2025 tax year, you’ll need to start from 6 April 2026.

- If your qualifying income is over £30,000 in the 2025–2026 tax year, you’ll need to start from 6 April 2027.

- If your qualifying income is over £20,000 in the 2026–2027 tax year, the government has set out plans for you to start from 6 April 2028, once legislation is in place.

If you’re new to running a B&B, you don’t need to start using Making Tax Digital until after you’ve submitted your first Self Assessment tax return. You can choose to sign up earlier, but it isn’t required until that first return has been filed.

What do you actually have to do under Making Tax Digital?

If it applies to you, you (or your accountant, if you use one) will need to use MTD-compatible software to:

- create, store and update digital records of your self-employment and property income and expenses

- send quarterly updates to HMRC

- submit your tax return through the software and pay any tax due by 31 January following the end of the tax year

What should you be doing now?

If you’re running a B&B in the UK, or planning to start one, it’s worth checking now whether Making Tax Digital will apply to you — particularly with lower income thresholds being phased in.

If you’re likely to fall into the next group required to join from April, this isn’t something to put off. You’ll need time to choose suitable software, speak to your accountant or bookkeeper if you use one, and get comfortable with the system before it becomes mandatory.

HMRC also provide webinars, videos and written guidance, but it’s far easier to deal with this in advance than at the last minute.

Stay connected with news and updates!

Join our mailing list to receive the latest news & updates from B&B Academy

Don't worry, your information will not be shared

We hate SPAM. We will never sell your information, for any reason. You can unsubscribe at any time